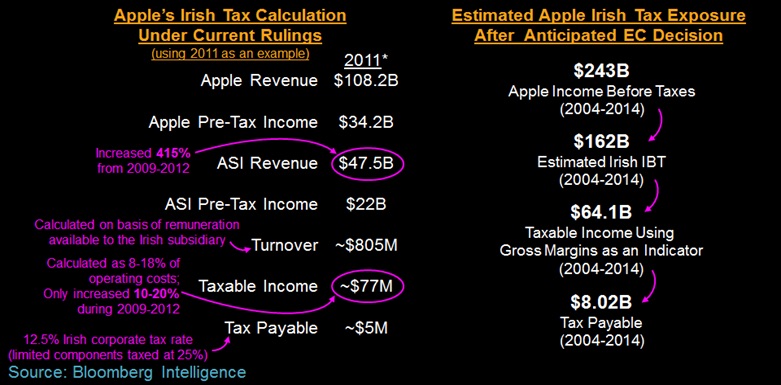

Apple could owe more than $8 billion in back taxes if the European Commission finds issue with the iPhone maker’s corporate tax policies in Ireland, according to analysis by Bloomberg Intelligence.

Apple could owe more than $8 billion in back taxes if the European Commission finds issue with the iPhone maker’s corporate tax policies in Ireland, according to analysis by Bloomberg Intelligence.

Apple is one of several multinational corporations that have been scrutinized for corporate tax avoidance in Europe over the past few years. The European Commission began Apple’s tax probe in June 2014, and formally accused the iPhone maker of receiving illegal state aid from Ireland three months later.

The company’s $64.1 billion in profit generated from 2004 to 2012 could be subject to a 12.5% tax rate, compared to its current foreign tax rate of about 1.8%, depending on the outcome of the investigation. A decision in the probe is expected in Brussels by March, possibly after the 2016 Irish election.

Apple’s tax breakdown in Ireland (Image: Bloomberg Intelligence)

Apple’s tax breakdown in Ireland (Image: Bloomberg Intelligence)

Apple operates multiple subsidiary companies in Ireland to pay significantly less tax outside the U.S., where it earns about 55% of its revenue. Apple continues to deny any wrongdoing, and both the company and Ireland vow to take the European Commission to court over any negative verdict.

Last month, Apple agreed to pay 318 million euros in Italy to settle an investigation that accused the company of booking profits generated in Italy through an Irish subsidiary, in an effort to lower its taxable income base and save 879 million euros between 2008 and 2013. Italian regulators concluded that tax probe in March.

Note: Due to the political nature of the discussion regarding this topic, the discussion thread is located in our Politics, Religion, Social Issues forum. All forum members and site visitors are welcome to read and follow the thread, but posting is limited to forum members with at least 100 posts.

Discuss this article in our forums

Source: MAC ROUMORS